The Growth You’ve Been

Dreaming Of Starts Here

We're the ONLY Full-Service Service Bureau that’s built for Tax Pros & EROs who desire and deserve MORE. We don’t just sell software—we give you the strategy, tools & resouces that DRIVE results.

Integrated Bank Products

& Software Suite

Done For You CRM &

Marketing Suite

Ethical Tax Education &

Back Office Resources

Minimal Up Front Cost,

Maximum Support & Efficiency

Work and train from anywhere, anytime. Our cloud-based platforms and

software suite ensures you can log in from any device, providing flexibility

and ease of use.

The Growth You Deserve Starts with The Bureau

We're the ONLY Full-Service Service Bureau that’s built for Tax Pros

& EROs who desire and deserve MORE. We don’t just sell software & Coaching

we give you the strategy, tools & resources that DRIVE rESULTS.

Integrated Bank Products

& Software Suite

Done For You CRM &

Marketing Suite

Ethical Tax Education &

Back Office Resources

Minimal Up Front Cost,

Maximum Support & Efficiency

Work and train from anywhere, anytime. Our cloud-based platforms and

software suite ensures you can log in from any device, providing flexibility

and ease of use.

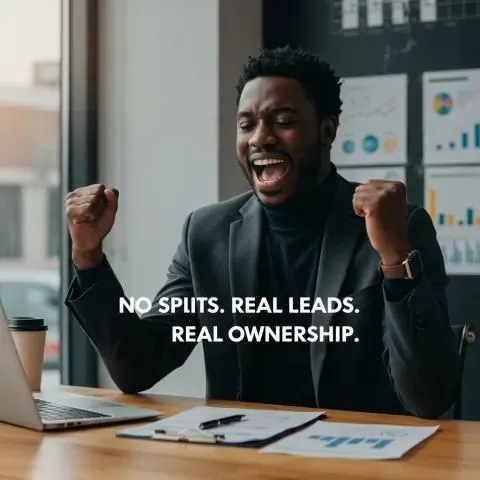

Welcome to a New Era of Tax Partnerships

No more restrictions. No middlemen.

No hidden agendas.

This is where Service Bureaus, EROs, and Tax Pros get real support, real resources, and real opportunities — without the runaround.

✔ On-demand training

✔ Real client leads

✔ Transparent pricing and payment schedules

✔ Immediate access to tools and mentorship

✔ Zero hidden upsells

You move at your pace. We match your effort.

This isn’t just a program — it’s a partnership built to grow with you.

LIVE & PRE RECORDED STRATEGY SESSIONS

Welcome to a New Era of Tax Partnerships

No more restrictions. No middlemen. No hidden agendas.

This is where Service Bureaus, EROs, and Tax Pros get real support, real resources, and real opportunities — without the runaround.

✔ On-demand training

✔ Real client leads

✔ Transparent pricing and payment schedules

✔ Immediate access to tools and mentorship

✔ Zero hidden upsells

You move at your pace. We match your effort.

This isn’t just a program — it’s a partnership built to grow with you.

LIVE & PRE RECORDED STRATEGY SESSIONS

NO GATEKEEPING | JUST PARTNERSHIP

NO GROWTH RESTRICTIONS. NO HIDDEN FINE PRINT. NO HIGH TICKET UPSELLS

Get Real Support, Real Resources, and Real Opportunities — Just For Showing Up!

✔ On-Demand Training

✔ Real Client Leads

✔ Transparent Pricing

✔ Payment Schedules

✔ Immediate Access

✔ Mentorship Tools

✔ Zero High Ticket Upsells

You Move At Your Pace. Results Match Your Drive & Effort.

This isn’t a DFY PROGRAM — It’s a PARTNERSHIP built to grow with SWEAT EQUITY INVESTMENT .

WEEKLY LIVE & PRE RECORDED STRATEGY SESSIONS

Welcome to a New Era of Tax Partnerships

No more restrictions. No middlemen. No hidden agendas.

This is where Service Bureaus, EROs, and Tax Pros get real support, real resources, and real opportunities — without the runaround.

✔ On-demand training

✔ Real client leads

✔ Transparent pricing and payment schedules

✔ Immediate access to tools and mentorship

✔ Zero hidden upsells

You move at your pace. We match your effort.

This isn’t just a program — it’s a partnership built to grow with you.

LIVE & PRE RECORDED STRATEGY SESSIONS

2025 PEAK TAX SEASON OPEN ENROLLMENT

EFIN PARTNER ENROLLMENT ENDS

PTIN PARTNER ENROLLMENT ENDS

The Blueprint Stands On Business:

Show Up Ready to BUILD & EAT

This isn’t a wait-and-see kind of program. If you’re serious about building your tax career with structure, closing client leads daily, and accessing real support options — THIS IS YOUR MOMENT. We’ve already mapped out the system. You just need Your EFIN and/or PTIN, and the drive to build your foundation; establish your OWN — it’s all here. All you have to do is show up - ON TIME- ready to WORK.

SOFTWARE, CLIENT LEADS & BANKING PRODUCTS

Access tax software and incoming leads from anywhere in the US and take tax prep on the go. Bank products leverage quick funds for clients while tax pro merchant accounts allow direct and flexible fee payment options.

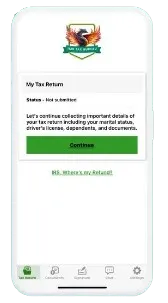

AUTOMATED CLIENT INTAKE CRM & MOBILE APP

Tax Pros: securely access client lead convo, status, metrics, contracts and much more. Clients: securely access financial services, records and info anytime, anywhere. Directly from the App Store.

SUPPORT, MARKETING, TRAINING

Completing annual tax theory training boosts professional credibility. TRMCRM software, customer service and marketing training ensure our partners close the clients lead we keep rolling in on demand!

We surveyed over 500 tax pros in late 2024 they all had the same complaints — you're tired of finding your own clients, paying for marketing, and still splitting your prep fees and paying high back end fees on top of everything else.

Get matched with software thats easy for YOU to use, CE, back office education and keep 100% of your client fees even if you don't have an EFIN* Ditch the completition. We provide real tax leads to help you make money all year long!

KEEP 100% of Your Client Tax Prep Fees

Get Real Client Leads To Grow Your Business

Learn How To Make Money All Year Long

We surveyed over 800 tax pros in late 2024 -2025, and they all had the same complaints —

1. 1 in 5 tax pros was tired of finding their own clients.

2. 3 in 5 tax pros said they were sick of paying for, software, marketing themselves, and still splitting the prep fees.

3. A whopping 5 in 5 tax pros were OVER paying high back end fees on top of everything else.

If ANY OF THIS hits home, get matched with software that's easy to use, year round CE, back office training and YOU keep 100% of your established client fees even if you don't have an EFIN* TMB Tax Bureau also provides real growth potential to help you make money all year long!

KEEP 100% of Your Established Client Prep Fees

Get Real Client Leads | Close More Tax Clients

Learn How To Make Money ALL YEAR LONG

Unlock VOLUME Based Incentives

No Glass Ceiling - No Growth Pressure

This isn’t cookie-cutter, entry-level fluff. This is a real partnership designed to put you in a position for growth in the tax industry, YOUR WAY. At TMB, we don’t just sign you up and leave you guessing — we plug you into a complete system: training, real clients, and the tools you need to build your career at your pace, on your terms. The Hustle, Drive & Dedication are the ONLY thing sold separately....but if you need a lil 1:1 motivation; we can do that for you too!

Comprehensive Tax Education

Dive into our Tax Pro Accelerator designed to provide you with a solid foundation in tax principles and compliance. This education is crucial for anyone looking to excel in the tax industry for 2025

Tax Software Access

Get your hands on the leading tax software options that fit your goals. This offer includes in-season technical support to ensure you're never left in the dark during crucial

tax filing periods.

Trained VA Support

Ever wanted to clone yourself? Our trained VA team are experts in the leading tax softwares, CRM, SMM, & marketing techniques for financial businesses for pennies on the dollar.

Volume Bonus Program

Boost your earnings with our volume bonus. For every bank product used in over 250 returns, earn additional money per return. This incentive is a fantastic way to increase your profitability as you grow your client base.

CoBranded Software

Expand your reach by CoBranding software under the TMB Tax Bureau umbrella. We provide all necessary materials, including software, training, and marketing tools, to set up your new software in 3 to 5 days or less.

Tax Office Funding

For our dedicated second and third-year students, we offer unique opportunities to secure start up funding. These financial aids are designed to help you open your own physical office or become a franchisee of TMB Tax Bureau,

NO FEE SPLIT PTIN PARTNER PRICING

KEEP 100% OF YOUR CLIENT TAX PREP FEES

BEGINNER & NEW TAX PRO

$597

$597 TODAY OR 8 PAYMENTS OF $97.97

FRESHMAN

PARTNER

Great for newbies to taxes and those new to the industry

Tax pro training & development, branding, software & leads

$97 To Get Started

$35 Return Review Compliance Fee

ASFP Cert, PTIN & Bond Required

MID LEVEL TAX PRO

$797

$797 TODAY OR 5 PAYMENTS OF 197.97

SOPHOMORE

PARNTER

Perfect for pros with 2+ years of prep experience

Niched education, adv marketing resources & leads provided

$197 To Get Started

$35 Return Review Compliance Fee

ASFP Cert, PTIN & Bond Required

ADVANCED TAX PRO

$997

$997 TODAY OR 4 PAYMENTS OF $297.97

JUNIOR

PARNTER

For pros ready to staff and run a brick & mortar tax office

SOP back office set up, software & office automation training included

$297 To Get Started

$35 Return Review Compliance Fee

PTIN & Bond Required, EFIN Optional

COBRANDED & READY

$2,497

$2,497 TODAY OR 6 PAYMENTS OF $497.97

GRADUATE

PARNTER

For pros seeking Co-Branded Software Sales w/ Incentives

Affiliate income w/CRM & Training Included

$497 To Get Started

$35 Return Review Compliance Fee

PTIN, EFIN, Req. E&O Insurance Suggested

The Bureau FAQ's

Got questions? We've got answers. Explore a list of frequently asked questions to better understand how The Bureau works, what to expect, and how we’re here to support you every step of the way. Got more questions? Chat with us or book a discovery.

Got questions? We've got answers. Explore a list of frequently asked

questions to better understand how The Bureau works, what to expect, and how we’re here to support you every step of the way. Got more questions? Chat with us or book a discovery.

Q1: What are the cost to join The Bureau?

PTIN Partners (No Hiring Fee) There’s no fee to be hired under our PTIN Partner Program. That said, there are a few industry-required costs we don’t control—such as your PTIN, bond, and ASFP training (if applicable). As well as compliance fees for quality control of each return. To onboard with your PTIN and proof of education simply select the RED PTIN Button.

The good news: you can still get started with TMB Tax Bureau support, coaching, and mentoring with as little as $50 down (based on the program you choose). We offer payment options, and we’re willing to work with you when life happens. Just keep in mind: active access requires an active subscription.

Need a little more time to pay? Tell us. We can often create a plan—because in this industry, communication is everything.

Email us, call us, or text us using the contact options below.It really is that simple.

EFIN Requirements (Software + Setup)

If you’re pursuing (or already have) an EFIN, here’s what you’ll need to operate and file professionally:

Professional tax software access: Current Pricing & Current Offers

A TRMCRM plan that matches your goals (cost is post trial):

Marketing Manger: $37/month (Social Media automation + 52 Week Playbook)

Manager Lite: $67/month (Tax Pro Setup + social tools + 24/7 KnowledgeBase)

Manager Pro: $97/month (CoBrand Software / Tax Team Onboarding / Prospecting)

Reliable computer + internet (and an updated browser like Chrome/Edge/Safari)

Professional email address

Ongoing active subscription to keep tools and access live

If you’re not sure which option fits your EFIN goals, reach out—we’ll point you to the best path based on whether you’re filing solo, building an ERO operation, or growing into a service bureau.

Q2: How soon can I get started? Why is attendance, PTIN & Payment details mandatory to onboard?

You can get started immediately. As soon as you handing your applicable enrollment requirements, submit your PTIN, and sign your training contract, you’ll receive access to your Member Portal—including our full training library. We STRONGLY encourage you to book your onboarding call and begin training the same day you enroll.

Why is all of that mandatory? Because we’re building professionals—not spectators. Attendance/participation is required so we know you’re serious about getting in and doing the work. Your PTIN is required because this is a regulated industry and we must verify you’re eligible to operate under our program.

Pay out details are required because your access is tied to an active subscription—and we need your account set up correctly from day one so you can get paid and any corresponding fees are accounted for.

We take your career seriously. That’s why we provide training, systems, and support at a level that many people pay thousands to access elsewhere.

Bottom line: participation is mandatory. If you don’t show up, don’t engage, or don’t maintain your onboarding requirements, you will be removed from the program.

Q3: Does The Bureau provide clients?

PTIN Enrollment (What You Get)

All PTIN enrollments include full access to our Tax Associate & Prospecting Package which includes client lead referrals consistent with your work output.

EFIN Enrollment (What You Get)

If you’re enrolled in a Sophomore+ ERO CRM, you’ll also get built-in prospecting tools designed to help you grow your client base.

Note: additional costs may apply after the trial period ends.

No Half Stepping (Show Up to Show Out)

Every training track includes our Marketing Bootcamp—an accountability community with a powerful, step-by-step system to help you attract and convert your own leads fast. Get immediate access to the public groups like The Tax & Revenue Accelerator, Revamp your social media with tools 100 Days of Taxes and the 52 Week Tax Pro PlayBook.

No High-Ticket Upsells (What’s Included)

Your TRM-CRM trial may include tools that require additional opt-ins, depending on the program you choose—but here’s our promise: we don’t do high-ticket upsells. Any add-ons are low-cost, typically ranging from $9.99 to $89.97, based on what’s included. Most importantly: our systems guide you play by-play, so you’re not starting from scratch.

Included with access:

Built-in prompts to help you write and post faster

A calendar to plan and stay consistent

A built-in journal to track goals, progress, and follow-ups

Weekly drop-in training access (so you can get support in real time)

When upsells do happen, they’re “REVENUE PLUG” options—not required to succeed. These can include a VA who provides custom designs for your brand and/or plug & play Canva Ready Templates for your brand and /or your team.

Q4: Do I need an EFIN?

EFIN Enrollment (Have One or Planning to Apply)

If you already have your EFIN—or you’re planning to apply for one—we’d love to support you as you build and grow.

Please choose our EFIN Enrollment to join The Bureau.

If someone doesn’t have an EFIN but has strong experience, they can still start their tax career under the PTIN Partner track. Use our tier to classify yourself as a PTIN Pro (based on experience + production) or take the PTIN Placement Quiz to be sure. Scale up with more advanced workflows, prospecting, and operational support—Don't get stuck at “entry level” just because its a NEW EFIN.

Here’s the full rewrite with everything you asked to include (Join-page ready):

PTIN Enrollment (Work Under the TMB Tax Family)

We have a program for experienced tax professionals who want to work under our brand as part of the TMB Tax Family.

With PTIN enrollment, you’re able to prepare taxes under our brand, with systems and support behind you—however, you cannot:

Own your own tax business while enrolled in this program, or work for another tax company at the same time. To sign up, simply choose PTIN below.

No EFIN Yet — But You’re Experienced?

No problem. If you don’t have an EFIN but you do have a strong background, we can place you into a higher tier (ex: PTIN Pro) and scale your opportunity based on your experience and output. Not sure which tier fits you best? Book a Discovery Call so we can recommend the cleanest path.

EFIN Enrollment (Have One or Planning to Apply)

If you already have your EFIN—or you’re planning to apply for one—we’d love to support you as you build and grow.

Please choose our EFIN Enrollment to join The Bureau.

Q5: What are the Lead Magnets, Revenue Plugs & KPIs?

Lead Magnets (Free) Lead magnets are free resources designed to help you engage your audience and collect leads (name/email/phone).

We design these for our partners so you have something valuable to post, share, and use to start conversations. Examples: checklists, write-off guides, document lists, mini trainings, etc.

Revenue Plugs (Upsell / Done-For-You Campaigns) Revenue Plugs are branded, ready-to-launch campaigns you can plug into your business to convert those lead magnet leads into booked appointments and paying clients. They’re an optional upsell because they include the full follow-up system—built and branded—so you don’t have to piece it together.

A Revenue Plug can include:

A branded landing page (built to capture leads)

Social media templates to promote the free lead magnet

Email + text follow-up templates to nurture and convert

Optional scripts/CTAs and campaign assets (depending on the bundle)

How they help you scale Lead magnets help you attract attention. Revenue Plugs help you monetize that attention—faster, with consistency, and with a system that looks like a real brand.

KPI Tracking (Built Into the CRM)

The best part is you’re not “posting and hoping.” Inside the CRM, we track performance using KPIs so you know what’s working and what needs tightening. Common KPIs we track based on your pipeline + automations:

New leads captured (per day/week)

Speed to lead (how fast you follow up)

Contact rate (how many leads you actually reach)

Appointment bookings

Show rate (booked vs. showed)

Close rate (showed vs. paid)

Pipeline value (what revenue is sitting in your stages)

So lead magnets help you attract leads, Revenue Plugs help you convert them—and the CRM helps you measure and scale it with real numbers.

If you tell me what you call your pipeline stages (ex: New Lead → Contacted → Booked → Paid), I’ll tailor the KPI list to match your exact workflow.

Q6: Are banking product required? How do I keep 100% of my existing client fees?

No — you don’t have to use bank products. Bank products are optional, in our business model and not all of your client base will be eligible for a Refund Advance, Banking partners decide what clients are approved for.

What are bank products (in plain terms)?

They’re options that let clients pay your prep fees out of their refund (instead of paying upfront). That convenience can help some clients move forward faster—but it can also come with rules and processing steps.

How do you keep 100% of your existing client fees?

You keep 100% of your fees by instructing your existing client base to utilize your unique Tax Pro Link for onboarding. Whatever fees you set will be routed to you depending on the client payment method.

Most common ways:

Client you pays upfront (card, invoice, cash app options, etc.).

Direct pay links/invoicing CRM or Merchant account system.

Clear fee agreements + payment collected before filing (where applicable)

If you have an EFIN (or you’re actively applying for one):

You can position yourself to purchase your tax software directly and operate under your own tax business structure.

What having an EFIN changes.

With an EFIN track, you’re building your operation—so you can:

Set up your own filing workflow (based on your approvals and provider requirements)

Choose the software package that fits your volume and business goals

Scale with more control as you grow

What you’ll need to purchase software direct (high level)

Software providers typically require:

An active EFIN (or proof you’re in process, depending on provider)

Your business information (entity + contact details)

Any required compliance items tied to the provider (varies)

A setup call / onboarding steps to activate your account

How The Bureau supports you

When you choose EFIN Enrollment to join The Bureau, we help you:

Choose the right lane (solo preparer vs ERO growth path)

Get your systems organized (pipeline, follow-up, training, and marketing)

Avoid common setup mistakes that slow people down in season

Long story short, no, bank products are not required to join The Bureau, you can purchase software direct as well!

Q7: What Is The Affiliate Income Training?

Affiliate Income Opportunities (Optional)

As you grow with The Bureau, you may also have the option to opt into affiliate income opportunities. These are designed for tax professionals who want to earn beyond tax prep by recommending tools, services, or programs that support their clients and/or their own business.

What it can include (examples)

Depending on your track and eligibility, affiliate options may include:

Referring business tools and support services

Referring education, training, or professional resources

Referring select software or partner programs (when available)

Important: Training + licensing may be required

Because we take compliance seriously, some affiliate opportunities require:

Additional training

Licensing and/or certification

Meeting minimum performance and compliance standards

How you qualify

Affiliate options are not automatic. They’re typically offered to partners who:

Stay active and in good standing

Complete required training tracks

Follow program guidelines and compliance expectations

PARTNER TESTIMONIALS

PULLING BACK THE INDUSTRY CURTAIN:

HOW TAX PROFESSIONALS MAKE MONEY ALL SEASON LONG BY AUTOMATING THEIR OFFICES

How to scale your tax

firm to 100+ clients

How to retain clients

season after peak season

How to attract clients that pay $400+ per return

You Get OPTIONS When You're Patnered With The Bureau

TAX THEORY 101

Join us weekly as we break down EVERYTHING you need to know about Tax Theory. You'll enjoy 17 jam packed modules, interactive tools and resources as well as weekly lives and exclusive offline group membership and bonus classes!

PROFESSIONAL SOFTWARE

Tax Revenue Manager provides intuitive online tax software solutions with 24/7 in season tech and tax pro support.

Interview mode, e-filing, bank products and so much more! And you still get to keep 100% of your prep fees!

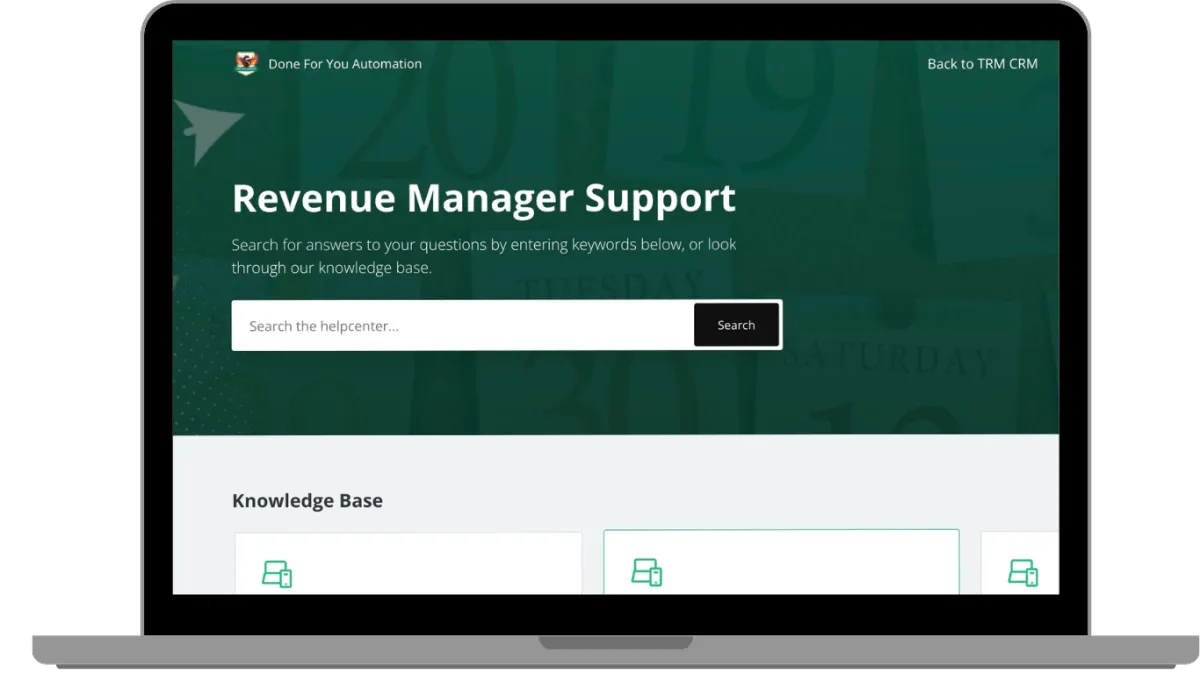

THE DONE FOR

YOU CRM

We include a done-for-you CRM, fully built and ready to use. TRMCRM 1040 comes with your membership and includes branded emails, client forms, workflows, and automated updates — so you can stop chasing clients and start managing your firm like a pro.

You Get OPTIONS When You're

Partnered With The Bureau

ACCOUNTABILITY & TRAINING SESSIONS

Join us weekly as we break down everything you need to know about Tax Theory and Tax Firm Compliance—the right way.

Inside, you’ll get:

Inclusive (and recommended) CE options

Fresh scaling content to help you grow beyond “just filing”

Interactive tools that make implementation easier

Free and affordable resources you can use immediately

Personalized recommendations based on your track and goals

Weekly live sessions, plus replays and bonus classes

Exclusive offline group membership for real community + accountability

THE STEP BY STEP BLUEPRINT

I built my tax business the hard way—so you don’t have to.

Inside this Accelerator, you get step-by-step guidance to help you skip the mistakes that cost tax pros time, money, and peace. There’s no gatekeeping here—just real support and real structure.

You’ll get direct access to:

Videos and ebooks

Resources, journals, and templates

Live meetings and weekly drop-in training

Community + real connections that keep you accountable

No expensive paywalls. No guessing. No running in circles.

Just clear moves to help you grow your business, serve clients with confidence, and build something real.

The only question is: are you committed to showing up?

DONE FOR YOU SYSTEMS

When you work with TMB, you don’t get random advice — you’re plugging into a real team dedicated to keeping your business strong and moving forward in real time.

Every week, you’ll tap into the same systems and CRM we use to run our firm, supported by live check-ins, updates, and trainings you can watch anytime.

Together, our staff, teachers, and mentors help you lock in:

Marketing that actually converts

SOPs so your business runs clean

Software + workflow so nothing falls through the cracks

Compliance so you stay protected and professional

And most importantly: real client opportunities you can act on fast

This isn’t just hustle. This is a real business, backed by a whole team that’s here to see you win.

24/7 Knowledge Base

Accountability Community

Affiliate Income Training

Bank Product Training

Tax Software Training

Plug & Play CRM & Training

Guerilla Marketing Bootcamp

CE Education & Downline Training

Back Office Compliance

Crisis Management Tools

Lead Magnet & Ads Training

Tax Prep Leads Provided

Promotional Materials Included

CoBranding Options

High Volume Incentives

Compliance Form Branding

Due Diligence Compliance Kit

JOIN THE BUREAU

CHOOSE FROM OUR PTIN, EFIN AND DIRECT SOFTWARE OPTIONS BELOW

JOIN THE BUREAU

CHOOSE FROM OUR PTIN, EFIN AND DIRECT SOFTWARE OPTIONS BELOW

PLEASE NOTE: ONBOARDING REQUIRES YOUR PROFESSIONAL CREDENTIALS AND/OR PAYMENT DETAILS. PLEASE BE READY TO PROCEED FOR PROMPT ACCESS.

© Copyright 2026. TMB TAX BUREAU. All rights reserved.